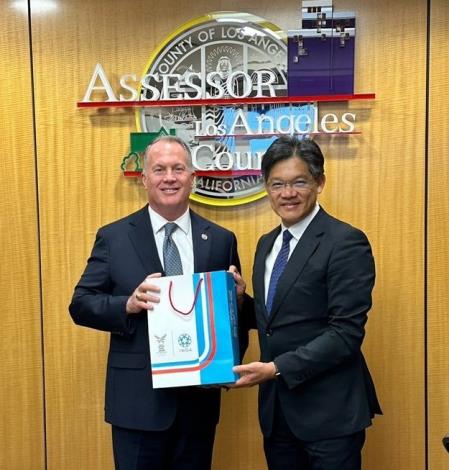

DOF, Taipei City Government, and the Los Angeles County Assessor's Office - Professional Property Appraisal Discussion.

On August 31, You Shih-Ming, the Commissioner of the Department of Finance (DOF), Taipei City Government, visited Assessor Jeff Prang, the County Assessor of Los Angeles, USA, for a bilateral exchange. The Los Angeles County Assessor's Office is the largest local property assessment agency in the United States, with 1,400 employees. It conducts an annual property assessment, covering an estimated area of over 4,000 square miles, including all taxable property. Assessor Jeff Prang led Chief Deputy Assessor George Renkei, Assistant Assessor Steven Hernandes and Scott Thornberry, District Appraisals Director Jennifer Budzak, and colleagues, held a meeting with Commissioner You, Subdivision Chief Zheng of DOF, and Section Chief Zheng of Taipei Economic and Cultural Office in Los Angeles. Assessor Prang leads the Los Angeles County Assessor's Office and is actively involved in the ongoing construction of the Assessor Modernization Project (AMP), which includes the adoption of state-of-the-art property assessment systems in collaboration with Oracle Corporation. Los Angeles County assesses all real properties with three major appraisal methods and computer-assisted appraisal. The taxable value is determined by multiplying the assessed market value by the assessment ratio and then subtracting any applicable exemptions based on different statuses. This forms the foundation for calculating annual property tax payable amounts by property owners. The homeowner can apply for an exemption of $7,000 in assessed value if the property is their primary residence as of the January 1 assessment date. The statutory responsibility of the Los Angeles County Assessor is to uncover every piece of property and to assess its fair market value. According to data released by the Los Angeles County Assessor's Office in July 2023, the total assessed value of property in Los Angeles County is approximately 2 trillion dollars, with a total of 2.39 million properties. Among these, more than 794,000 properties are in the City of Los Angeles, with a total assessed value of approximately $819.7 billion. Commissioner You stated that in the first half of this year, Taipei City Government reassessed the standard property prices of 1.3 million properties in accordance with its once-every-three-year schedule. They sought advice on various aspects, including the LA assessment ratio, property valuation methods, property division methods, Computer Assisted Mass Assessment (CAMA), and Multiple Regression Analysis (MRA) application, as well as variable selection. Assessor Prang explained that California has a very unique Proposition 13 (Prop. 13), which limits property taxes to 1% of assessed value, and the assessed value cannot increase by more than 2% annually. This is different from the equalization rates adopted by New York State for assessing property values in various cities. Commissioner You also explained that in our country, based on the concept of average land rights, land value tax and property tax are assessed separately, unlike the United States, which often adopts combined property assessment. In addition to assessing the present values of 1.3 million properties using the cost-measuring approach, the Taipei City Revenue Service has also divided them into 1,351 sections and adjusted the rates based on market comparison trends. Specifically, 230 sections have been adjusted using the COD and PRD indicators as reference, with the aim of achieving a fairer and more reasonable property tax assessment. The Lincoln Institute in the United States previously estimated that the effective tax rate in Los Angeles was approximately 1.16% for the year 2021, based on the median property tax to median home price ratio in 53 major cities across the country. While Taipei City has the highest property tax effective rate in the country, it is still much lower than that of Los Angeles. In the meeting, discussions were also held regarding the 2023-2024 budget of the City of Los Angeles. The city government estimates a total revenue of USD 13,064,121,734 (13 billion), with 60.2% of it being classified as General Receipts. Among these general receipts, property tax revenue is notably high, reaching nearly $2.66 billion USD, accounting for 20.4% of the total revenue. The Los Angeles County Assessor's Office plays a crucial role in the annual property assessment, making it one of the significant sources of government revenue for public administration. During this meeting, Commissioner You and Assessor Prang had a comprehensive discussion on appraisal techniques and property taxation issues. The experiences and practices in Los Angeles are worth reference by various county and city government finance and land management agencies in the country. Commissioner You presented Assessor Jeff Prang with promotional souvenirs for the 2025 World Master Games, inviting him to promote participation and tourism in Taipei during the event. The meeting also had the presence of the well-known local Mandarin television news in LA and local media World Journal for coverage. The professional communication in international property assessment and the promotion of government policies have both been quite successful.

![Taiwan.gov.tw [ open a new window]](/images/egov.png)